Prevent 6 Second Garage Door Break In.

This is an easy fix which I did right after I saw this video

Displaying blog entries 1-10 of 59

This is an easy fix which I did right after I saw this video

1. Homes have increased in value and the demand is up. There was a 10.1% increase in home values in November to $180,000 average from a year ago per National Association of Realtors. Nine consecutive months of home price increases accross the U.S.

2. Record low loans will be a thing of the past. Rates will be increasing to 3.5-4% says senior Analyst Greg McBride with Bankrate.com. Now, barring any unusual changes in the economy interest rates should hold steady. Cost of getting a FHA will mostly likely increase this year. Reserves are at all-time lows and with the Federal Housing Administration Fiscal Solvency Act of 2012 it gives them authority to raise premiums to build back up its reserves

3. Inventory of existing home down again in November by 3.8%, fewer distressed properties for sale, and lowest inventory since 2005.

4. New rules to protect home buyers from predatory lenders. Ability to repay rule, which takes place in January 2014 but most lenders will put in place this year. This should stop the risky practices such as interest only and "No Doc" loans that help create this mess in the first place. To many loans in the past set the buyer up to fail with loans they could never afford.

5. Home-Equity loans are back. Just like home loans, home equity loans have been going down too. Home prices appear to be going up again lenders will be competing for your home equity business.

6. There are less and less distressed home deals to buy. Banks are giving distressed homeowners a chance to stay in their homes by giving them principal reductions as a way of avoiding short sales.

7. New construction is up a whopping 27% over a year ago. Record low interest and increase in employment has spurred builders to break ground on new home projects.

8. You missed the bottom of the home sales market but prices are still at record lows. It’s time to check with a Realtor to see if it’s right for you to buy a home now. If you wait too long you may find the market will pass you by again.

Call Carol at 714-726-3166 or Carol@carolandjim.com

U.S. housing permits rise for the third month in May 2012. The Commerce Department said builders broke ground on 3.2% more single-family homes and April figures revised up to 744,000 - fastest building pace since October 2008. 780,000 permits were requested by builders the largest number since September 2008.

South Florida has seen an increase in foreign spending on real estate and tourism, Canada, South America, and even Europeans have been actively buying properties in areas of distressed residential real estate.

Austin Texas homes prices rise 6.5%, home prices appreciating at a higher rate than the national average and this includes distressed sales according to a report by CoreLogic.

Las Vegas is beginning to see a glimmer of renewed hope with a 90.4 percent increase in building permits and new-home builders have started increasing their home prices by $1000-$5000.

Arizona ranked third for construction job growth in May. It’s happening all over the country signs of renewed hope that the housing market is truly on the mend.

California, 44% percent of all properties sold had multiple offers this year. Orange County California, personally are sales are up, multiple offers, homes selling over listing price, and Open Houses with a continues flow of potential buyers. Inventories are at the lowest level in years. Brea California today: 44 active listings, 92 with offers to purchase accepted by sellers (pending sales or taking backup offers), and 141 closed home sales since the first of the year with an average of 26 per month.

Steady builder confidence in June good article atThe Natioanl Association of Home Builders (NAHB) webiste

Opportunities knocking, will you be the one to take advantage of it this time?

If you are thinking about buying or selling a home, give us a call at (714) 726-3166 or send us an email to explore your options and to find out when is the best time for you to make a move. Texting ok

You just found the perfect home on Zillow and pick up the phone to call your real estate agent and boy are you excited you want to go see it now! Your agent says let me look up the property to call the home owner. Sign on to CRMLS to look up the property on the Multiple Listing Service (MLS) and get the phone number and staring right at the top of the page is "PENDING SALE". Your shoulders visibly sag and you tell your client your dream home is already sold and everyone is disappointed.

want to go see it now! Your agent says let me look up the property to call the home owner. Sign on to CRMLS to look up the property on the Multiple Listing Service (MLS) and get the phone number and staring right at the top of the page is "PENDING SALE". Your shoulders visibly sag and you tell your client your dream home is already sold and everyone is disappointed.

I can’t tell you how many times this happens. Unfortunately this is one problems looking for homes using internet homes for sale websites. The only properties you can see on these websites are the active listings. What does the word active listing mean? An active listing is any property listed on our MLS that is NOT a closed sale. Active listings include; Pending Sales, Taking backup offers, hold do not show, properties do fall out after a contract is signed to purchase that is the reason they stay active.

I can’t tell you how many times this happens. Unfortunately this is one problems looking for homes using internet homes for sale websites. The only properties you can see on these websites are the active listings. What does the word active listing mean? An active listing is any property listed on our MLS that is NOT a closed sale. Active listings include; Pending Sales, Taking backup offers, hold do not show, properties do fall out after a contract is signed to purchase that is the reason they stay active.

When you look at the chart on the right the first section “CRMLS” is the information out of our real estate Multiple Listing Service. At that date and time these were all the active listings without; pending sales, taking backup offers, and hold do not show. When you look down the graph there are significant differences from the CRMLS making it impossible to really know what is active listing, doesn’t it. Prudentialproperties.com, site works different that the rest. It shows: “ Newly listed within the past 15 days”. So anything active more that 15 days are not shown in the search results, but it still has all the pending sales, taking backups, and hold do not show properties. So in the end it doesn’t show all the active listings in the MLS.

Now, you can see why when looking on the internet for homes for sales it can be disappointing. What it is good for is picking out an area you would like to live in, see how much properties are listed for in specific area, and find out about the city you want to live in. Beyond that there can be a lot of heart ache. It’s always better to receive your home search information directly from a real estate agent. It will be up to date and should be accurate.

Reference: this is my opinion below I’m sure other agents may have somewhat of a different view.

Active Listing: any property listed for sale on MLS that is NOT a closed sale.

Taking Backups: A property for sale that has an accepted contract to purchase, but the buyer has not yet removed all the buyers’ contingencies. Home inspections, appraisal, final loan approval, disclosures haven’t been approved, etc.

Pending Sale: All contingencies have been removed waiting for loan docs to be drawn, signed and then to close.

Closed Sale: Everything is done and buyer can move in the property they have purchased.

CRMLS: California Regional Multiple Listing Service, Inc. The member service I belong too.

If you are ready to start the process you will find our Home Buyers Guide Helpful

If you are thinking about buying or selling a home, give us a call at (714) 726-3166 or send us an email to explore your options and to find out when is the best time for you to make a move. Texting ok

Today my wife (Carol) had a call from a new client who was very angry with her. She hadn't even shown them any property yet. The client was referred to us by their lender whom she had had occasion to work with before. The buyer called Carol about a specific home in Anaheim Hills they had fallen in love with on paper. Carol called the agent who said they already had a strong offer over list price with 25% down and great FICO scores, and he would call if anything happened to that offer, even taking her cell phone number. Carol conveyed the information back to the buyers and emailed them several other properties similar in size and price range. The arrangements were made to view the available properties on Saturday 4 days later. The next day the buyer saw it still available on the web and called the listing agent. He told them the home was available and would they like to see it.

Now you know why the buyer was angry with Carol?

After about 20 minutes of conversation going over what the selling agent and Carol talked about, the client realized Carol conveyed the information the selling agent had given to her. Of course when Carol called back the listing agent his comment was the first offer fell out and they accepted another offer on the same day. In the past we had had a good relationship with this agent and would never have figured he would of played these kinds of games. This is not the first time and it probably won't be the last time this type of thing happens to all of us in today’s cloudy real estate ethics market. We Hate Disingenuous Real Estate Agents!

If you are ready to start the process you will find our Home Buyers Guide Helpful

If you are thinking about buying or selling a home, give us a call at (714) 726-3166 or send us an email to explore your options and to find out when is the best time for you to make a move. Texting ok

Is it time to buy your first home? Well, if you are paying $2200 a month on rent, then it may be time to make that move into homeownership. With as little as 3% down payment and closing costs (some of which you can as the seller to pay for you) you can buy a home for $350,000 and be paying the same amount in house payment as you are paying in rent. Some cities have first time buyer programs or there may be federal programs available to help with silent seconds or down payment assistance. Plus you gain a tax benefit from being able to deduct the interest and property taxes from your gross income. Of course talk to a good lender, which we can help you find, before you get started in your home buying search.

So, is it the time for you to buy and become a homeowner?

|

Loan Information |

|

|

Loan amount |

$340,000 |

|

Annual interest rate |

4.25% |

|

Number of months |

360 |

|

Monthly principal and interest payment |

$1,672.60 |

|

Monthly property taxes |

$291.67 |

|

Monthly hazard insurance |

$87.50 |

|

Monthly PMI (if applicable) |

$147.33 |

|

Total monthly payment (including taxes, insurance, and PMI) |

$2,199.10 |

If you are ready to start the process you will find our Home Buyers Guide Helpful

If you are thinking about buying or selling a home, give us a call at (714) 726-3166 or send us an email to explore your options and to find out when is the best time for you to make a move. Texting ok

We are experiencing a change in the market and it started in the last quarter of last year and has continued to improve in the first quarter of 2012. If you have been trying to buy your first home you have seen an increase in prices and properties selling pretty fast. The last four first time buyers we found homes for lost more than 3 houses before they were successful in finding a home they could buy. That right they lost out on at least 3 homes before they were successful at getting a signed contract to purchase. Looking at the sales chart below you find some very interesting numbers.

|

January 2012 Home Sales in Anaheim Hills, Anaheim, Brea, Fullerton, Placentia, and Yorba Linda |

|||||||||||||

|

City |

New |

Avg LP |

Under Contract |

Avg LP |

Sold |

Avg SP |

%SP/LP |

%SP/OLP |

Avg DOM |

||||

|

AH |

73 |

$486,111 |

16 |

$529,937 |

25 |

$440,443 |

96.39% |

94.87% |

105 |

||||

|

ANA |

195 |

$335,218 |

81 |

$297,480 |

111 |

$309,031 |

97.61% |

93.28% |

95 |

||||

|

BREA |

35 |

$522,852 |

15 |

$499,292 |

20 |

$423,173 |

97.42% |

94.17% |

114 |

||||

|

FUL |

127 |

$463,362 |

36 |

$477,019 |

60 |

$429,679 |

97.09% |

93.27% |

101 |

||||

|

PLA |

44 |

$395,849 |

23 |

$399,486 |

33 |

$401,843 |

98.00% |

94.40% |

100 |

||||

|

YL |

106 |

$744,741 |

23 |

$546,963 |

46 |

$598,107 |

96.21% |

92.75% |

104 |

||||

|

|

580 |

$491,355 |

194 |

$458,362 |

295 |

$433,712 |

97.12% |

93.79% |

103 |

||||

|

February 2012 Home Sales in Anaheim Hills, Anaheim, Brea, Fullerton, Placentia, and Yorba Linda |

|||||||||||||

|

City |

New |

Avg LP |

Under Contract |

Avg LP |

Sold |

Avg SP |

%SP/LP |

%SP/OLP |

Avg DOM |

||||

|

AH |

64 |

$790,142 |

19 |

$569,340 |

36 |

$507,219 |

96.06% |

91.27% |

111 |

||||

|

ANA |

197 |

$326,692 |

89 |

$286,634 |

114 |

$292,256 |

98.48% |

92.81% |

100 |

||||

|

BREA |

39 |

$590,308 |

14 |

$510,025 |

20 |

$401,128 |

97.43% |

95.45% |

79 |

||||

|

FUL |

125 |

$481,474 |

51 |

$405,897 |

88 |

$420,851 |

97.06% |

94.05% |

98 |

||||

|

PLA |

54 |

$391,488 |

17 |

$428,616 |

27 |

$362,418 |

97.99% |

96.43% |

75 |

||||

|

YL |

88 |

$692,805 |

31 |

$640,264 |

59 |

$536,795 |

98.25% |

95.54% |

96 |

||||

|

|

567 |

$545,484 |

221 |

$473,462 |

344 |

$420,111 |

97.55% |

94.26% |

93 |

||||

|

March 2012 Home Sales in Anaheim Hills, Anaheim, Brea, Fullerton, Placentia, and Yorba Linda |

|||||||||||||

|

City |

New |

Avg LP |

Under Contract |

Avg LP |

Sold |

Avg SP |

%SP/LP |

%SP/OLP |

Avg DOM |

||||

|

AH |

59 |

$641,372 |

28 |

$502,671 |

38 |

$464,142 |

96.26% |

93.06% |

103 |

||||

|

ANA |

201 |

$317,072 |

132 |

$313,299 |

138 |

$307,626 |

102.39% |

99.04% |

89 |

||||

|

BREA |

42 |

$467,117 |

18 |

$429,400 |

24 |

$520,951 |

98.80% |

96.57% |

75 |

||||

|

FUL |

128 |

$483,199 |

51 |

$406,241 |

81 |

$406,279 |

97.28% |

94.52% |

78 |

||||

|

PLA |

57 |

$452,223 |

22 |

$388,562 |

31 |

$356,003 |

99.21% |

93.92% |

84 |

||||

|

YL |

114 |

$727,115 |

37 |

$506,107 |

47 |

$558,593 |

97.10% |

89.34% |

88 |

||||

|

|

601 |

$514,683 |

288 |

$424,380 |

359 |

$435,599 |

98.51% |

94.41% |

86 |

||||

|

New |

Under Contract |

Sold |

Under Contract & Sold |

Days on Market |

|||||||||

|

Jan |

580 |

194 |

295 |

489 |

103 |

||||||||

|

Feb |

567 |

221 |

344 |

565 |

93 |

||||||||

|

Mar |

601 |

288 |

359 |

647 |

86 |

||||||||

Great news for sellers properties in the first time buyer category are selling fast and are going up in price. Bad news since a large number of the first time buyer homes are vacate we are not having the normal upward home purchases. There are a lot of good news in the data above but it’s too soon for balloons and firework. Read the data and make your own conclusions.

Thinking about buying a home and are tired of inaccurate data on the major websites. Our data comes straight from the MLS and the data is up dated daily. To sign up at www.forhomeinfo.us to have homes that fit your criteria emailed to you daily.

No matter how bad the housing market has been. I have never lost $80,000 on a house in one day. Unfortunately a number of my friends did just that lost over $80,000 in one day. Now I know that’s unusual and if you leave your portfolio along it will probably come back over the long term if you were invested in good companies.

Buying a home now is a wise decision. The stock market is going to be volatile for some time and home interest rates have not been this low since the 70's. There was an excellent article in "Smart Money" by Jillian Mincer, "Forget the Market. Buy A Home". We all need somewhere to live and at these interest rates if you have money buy now. Pay the home off as soon as possible if you can afford a 15 year loan due it even better a 10 year loan. If not, that’s ok too.

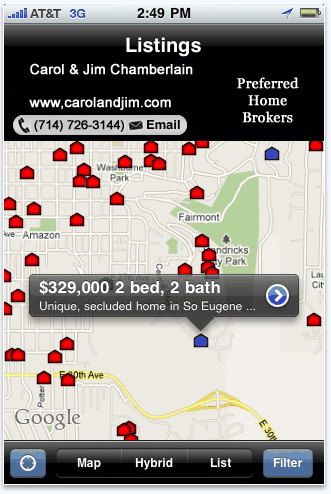

My Agent is the best iPhone app for house hunting I have ever used. Go anywhere click on the My Agent App and what you see is all the properties listed for sale all around you. Click on any of the houses and you can find what the price is and the bedroom and bath count. Click on the arrow in the same box and it opens up the picture of the house, Description, and more photos. Slide the map in any direction and more homes will show up. There is even a filter to adjust the minimum and maximum price, number of bedrooms, number of baths, and even the square footage. Fast, easy to use, and it’s free.

My Agent is the best iPhone app for house hunting I have ever used. Go anywhere click on the My Agent App and what you see is all the properties listed for sale all around you. Click on any of the houses and you can find what the price is and the bedroom and bath count. Click on the arrow in the same box and it opens up the picture of the house, Description, and more photos. Slide the map in any direction and more homes will show up. There is even a filter to adjust the minimum and maximum price, number of bedrooms, number of baths, and even the square footage. Fast, easy to use, and it’s free.

After you download the free app (My Agent by IDX) from the App Store you will have input a 4 digit password (4693) one time to be able to use the app. No, I have not used this app all over the country but I have used in Orange and Los Angeles Counties. Carol has found it very useful when showing property to buyers. There may be another home close by one Carol has picked to show and the buyers want to know why she isn’t showing them the house down the street. All she does is open up My Agent “Refresh the Map” and click on the house in question and she can show the buyer the house didn’t have enough bedrooms, or baths, or square footage was below the minimum they wanted.

When you’re driving around and see a new sign up in a neighborhood you can find out all the information quickly using My Agent. If your house hunting this is a must have app!

1. Mortgage rates are at an all time low when buyers take advantage of today rates they start building equity right away. You can handle a few up and downs as market gains momentum. Just a few years ago buyers would have jumped at chance to have a 6% interest rate on a home purchase. Today the rates are around 4.5%. Here's the best part on the purchase of a $300,000 home you will save over $102,000 of the life of a 30 year loan. Thats right over a $102,000 over the loan or $3,400.00 a year.

2. There are lots programs to help the first time buyer and middle-class families to buy home. Add one of these programs with today’s current low interest rates you can save even more cash.

3. Fannie Mae guidelines in the past have tied the appraiser’s hands on how they could value a home. These guidelines were so strict it made it difficult for an appraiser to give a fair and honest appraisal. Appraisers, now, can more accurately reflect the current values in their given markets with the changes made in the updated Fannie Mae guidelines.

4. Home owners have continued to maintain their homes and spend money on repairs and improvements. When these homes come up for sale they are much more desirable that the tired old foreclosed homes (REO’s) saving buyers thousands of dollars in repairs.

Displaying blog entries 1-10 of 59